Some Of Home Renovation Loan

See This Report about Home Renovation Loan

Table of ContentsHome Renovation Loan Things To Know Before You Get ThisHow Home Renovation Loan can Save You Time, Stress, and Money.Little Known Facts About Home Renovation Loan.4 Simple Techniques For Home Renovation LoanHome Renovation Loan Fundamentals Explained

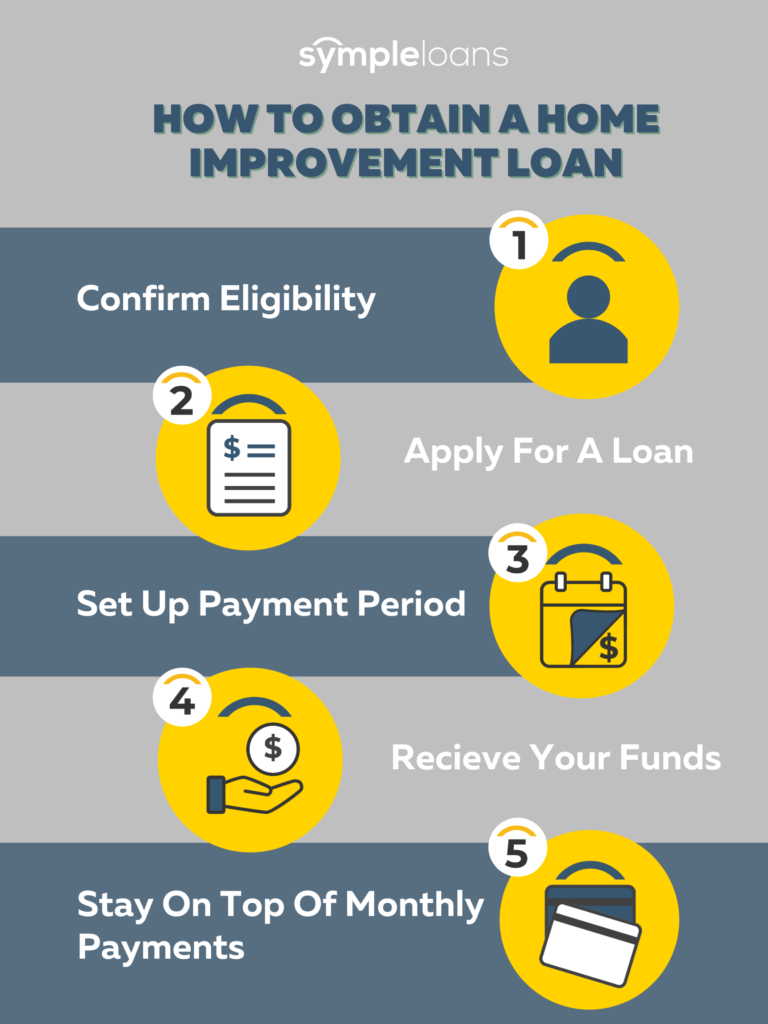

Numerous industrial financial institutions supply home enhancement fundings with minimal paperwork demands (home renovation loan). The disbursal process, however, is made easier if you acquire the loan from the same bank where you previously obtained a funding. On the other hand, if you are getting a finance for the initial time, you have to duplicate all the actions in the loan application procedureTake into consideration a home renovation lending if you desire to refurbish your house and provide it a fresh look. With the aid of these fundings, you may make your home much more aesthetically pleasing and comfy to live in.

The primary benefits of making use of a HELOC for a home restoration is the adaptability and low prices (normally 1% above the prime rate). Furthermore, you will just pay interest on the amount you take out, making this an excellent option if you need to spend for your home restorations in stages.

Excitement About Home Renovation Loan

The primary negative aspect of a HELOC is that there is no set settlement timetable. You have to pay a minimum of the passion on a monthly basis and this will certainly raise if prime rates increase." This is a great funding option for home remodellings if you intend to make smaller sized monthly payments.

Given the possibly lengthy amortization period, you could wind up paying substantially more interest with a home mortgage re-finance compared with various other funding choices, and the costs related to a HELOC will certainly also use. A home loan refinance is effectively a brand-new mortgage, and the interest price might be higher than your present one.

Rates and set-up costs are typically the same as would certainly pay for a HELOC and you can repay the financing early without any penalty. A few of our customers will begin their improvements with a HELOC and after that switch over to a home equity funding once all the prices are confirmed." This can be a great home renovation financing alternative for medium-sized projects.

The Facts About Home Renovation Loan Uncovered

Home improvement lendings this page are the financing alternative that allows homeowners to renovate their homes without needing to dip right into their cost savings or spend lavishly on high-interest bank card. There are a variety of home renovation loan resources readily available to select from: Home Equity Credit Line (HELOC) Home Equity Lending Home Mortgage Refinance Personal Lending Credit Card Each of these financing alternatives features unique demands, like credit report, proprietor's revenue, credit line, and rates of interest.

Prior to you take the plunge of making your desire home, you probably need to know the several sorts of home remodelling car loans available in Canada. Below are several of the most usual types of home improvement finances each with its own collection of features and advantages. It is a kind of home renovation loan that permits home owners to borrow a bountiful sum of cash at a low-interest price.

The Home Renovation Loan Ideas

To be qualified, you must possess either a minimum of at least 20% home equity or if you have a home loan of 35% home equity for a standalone HELOC. Re-financing your home mortgage procedure entails changing your existing mortgage with a brand-new one at a reduced rate. It lowers your month-to-month settlements and lowers the quantity of passion you pay over your life time.

It is crucial to discover the prospective dangers linked with refinancing your mortgage, such as paying more in passion over the life of the funding and costly costs varying from 2% to 6% of the loan reference amount. Personal car loans are unsecured loans best matched for those who need to cover home remodelling expenses quickly yet don't have adequate equity to receive a protected funding.

For this, you may require pop over to this site to offer a clear construction strategy and allocate the renovation, including calculating the price for all the materials called for. Additionally, individual financings can be protected or unsecured with shorter repayment periods (under 60 months) and featured a higher rates of interest, depending upon your credit history and earnings.

For tiny house restoration ideas or incidentals that cost a couple of thousand bucks, it can be a suitable choice. If you have a cash-back credit score card and are waiting for your following income to pay for the acts, you can take advantage of the credit history card's 21-day poise duration, throughout which no passion is accumulated.

The Ultimate Guide To Home Renovation Loan

Shop financing programs, i.e. Store credit scores cards are used by lots of home enhancement shops in Canada, such as Home Depot or Lowe's. If you're preparing for small-scale home improvement or DIY tasks, such as installing brand-new home windows or restroom restoration, getting a store card via the store can be a simple and quick process.

It is crucial to check out the terms and conditions of the program very carefully before making a choice, as you may be subject to retroactive passion charges if you fail to pay off the equilibrium within the time period, and the rate of interest rates might be higher than normal mortgage funding.